End to end UX | Risk profiling

Context: Vitality, a provider of health and life insurance, wanted to be able to offer risk profiling to its clients to support their investment choices. The challenges were:

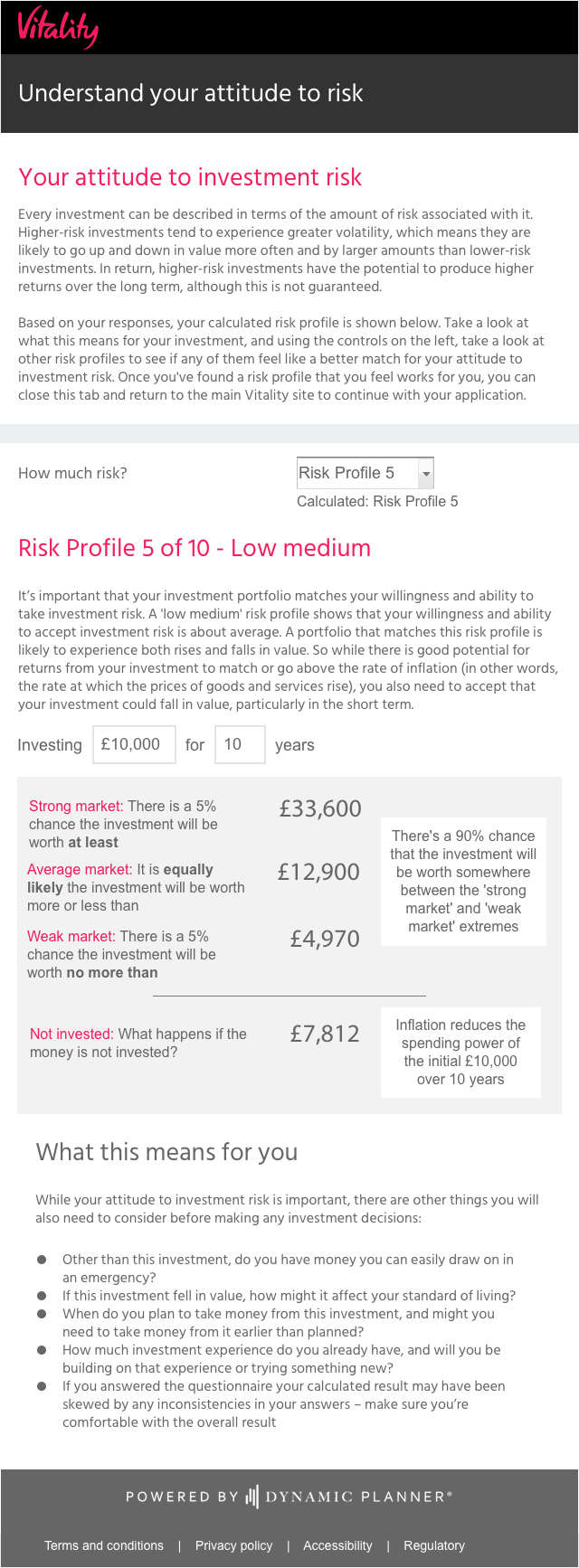

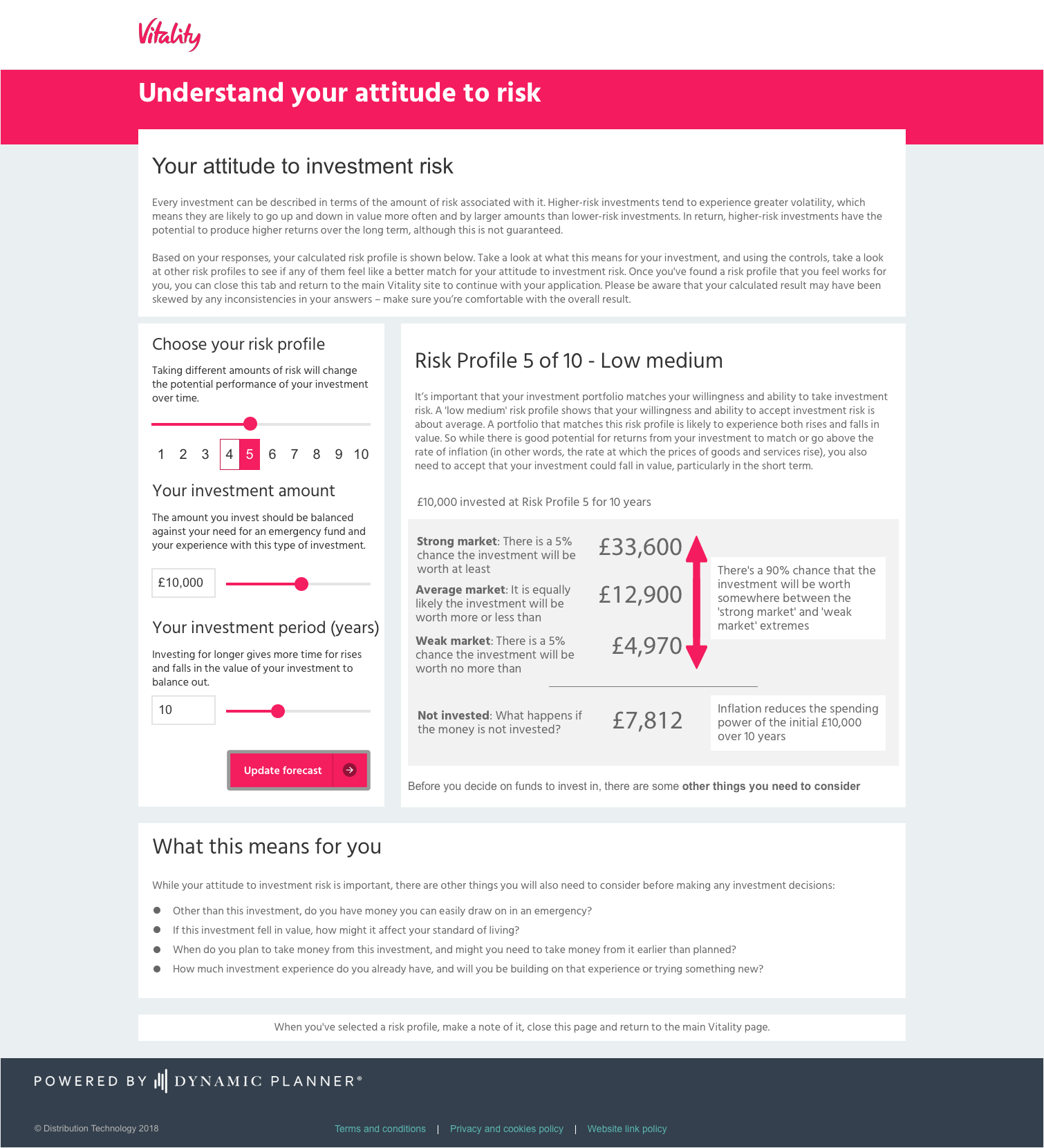

Making complex financial concepts easy for clients to understand while meeting the needs of a compliant financial process

Meeting Vitality’s requirements and brand guidelines

Developing a product that could be easily customised for other customers

My role

Business analysis: I worked with the client and internal stakeholders to define the requirements

Stakeholder management: I worked with stakeholders at Vitality to communicate our understanding and approach, listening to and responding to their concerns

Design and prototyping: I sketched out the user journeys and developed a responsive prototype in Axure

User testing: I tested the prototype with representative clients and refined the design

Agile development: I wrote user stories to support developers and testers in implementing the design

The outcome

The early work to clarify a firm set of requirements with the stakeholders meant that the design work proceeded with a clear understanding of the outcomes. Testing gave stakeholders confidence that this process would work with the target users, and the product was later sold to other financial institutions.